360 One Prime Limited (formerly known as IIFL Wealth Prime Limited) has come up with Secured, Rated, Listed, Redeemable Non-Convertible Debentures opening on January 11, 2024, and closing on January 24, 2024. This is an attractive investment opportunity for investors as it holds a credit rating of AA/Stable by CRISIL and ICRA, supported by the company’s strong profile and impressive financial track record. This blog delves into the details of the company, the issue, and its financial performance. Below are the details of the issue:

Issue Highlights

| Issuer Name | 360 One Prime Limited |

| Nature of Instrument | Secured Rated Listed Redeemable Non-Convertible Debentures |

| Rating | AA/Stable by CRISIL & ICRA |

| Seniority | Senior Secured |

| Face Value | Rs. 1,000 per NCD |

| Base Issue Size | Rs. 200 crore |

| Option to retain oversubscription | Rs. 800 crore |

| Coupon | Up to 9.66% |

| Tenor | 18/24/36/60 months |

| Issue Date | January 11, 2024, to January 24, 2024 |

| Minimum Investment | Rs. 10,000 only |

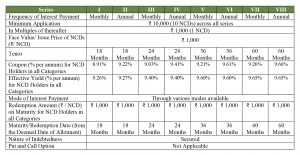

Specific Terms of the NCD Public Issue across different series

Company Profile

- 360 ONE Prime Limited, formerly known as IIFL Wealth Prime Limited, was incorporated as Chephis Capital Markets Limited on August 31, 1994, under the Companies Act, 1956.

- 360 ONE Prime Limited is an NBFC registered with the RBI and operates as a wholly-owned subsidiary of 360 ONE WAM LIMITED (Formerly known as IIFL Wealth Management Limited).

- The registered and corporate office is located in Mumbai.

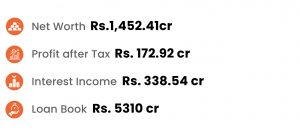

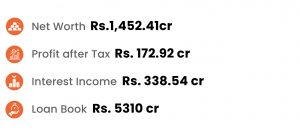

- As of 30th September 2023, the company’s loan book stood at ₹5,310 crore making it the leading NBFC in India by asset size in the wealth management industry.

- The products primarily include

a) Loans against Securities (LAS)

b) Loans against property (LAP)

c) Unsecured lending products

d) Term loans and advances

Performance Highlights of 360 One Prime Limited (as of September 30, 2023)

Financial Parameters of the Company (Standalone):

(Rs. in cr )

| Particulars | FY 2021 | FY 2022 | FY 2023 |

| Net Worth | 1,693.77 | 1,272.30 | 1,394.43 |

| Profit after Tax | 156.19 | 282.80 | 234.52 |

| Interest Income | 642.06 | 507.03 | 509.30 |

| % Net Stage 3 Loans on Loans (NPA) | 0.00% | 0.00% | 0.00% |

| Tier 1 Capital Adequacy Ratio | 22.06% | 23.18% | 19.52% |

| Tier II Capital Adequacy Ratio | 1.05% | 0.43% | 0.26% |

Financial Metrics across 360 One Prime Limited’s Businesses

- 360 One Prime Limited’s AUM has grown to ₹ 4,926.79 crore as of March 31, 2023, from ₹ 3,703.25 crore as of March 31, 2021. It experienced a significant growth at a CAGR of 60.47%, from ₹ 6,796.02 crores as of March 31, 2021 (excluding public issue funding business which has been discontinued) to ₹ 10,905.84 crores as of March 31, 2023.

- The total revenues from operations are ₹ 673.66 crores for the Fiscal 2023 as compared with ₹ 782.59 crores (excl. income on distribution business ₹ 188.06 crore) for the Fiscal 2021 and their profit for Fiscal 2023 was ₹ 234.52 crore as compared with ₹ 156.19 crore for the Fiscal 2021.

- The company’s net worth as of March 31, 2023, was ₹ 1,394.43 crore and has grown at a CAGR of 19.78% over the net worth as of March 31, 2021 (excl. distribution business) of ₹ 1,018.53 crore.

- The company’s Loan Book grew at a CAGR of 33.04% to ₹ 4,926.79 crore as of March 31, 2023, from ₹ 3,703.25 crore as of March 31, 2021.

Rating Rationale

The rating rationale outlines the following key factors influencing the ratings of 360 One Prime Limited:

Strengths

-

A dominant presence in the wealth management business

360 ONE caters to premium wealth clients and offers advisory, asset management, broking, and distribution services to high-net-worth individuals (HNIs) and ultra-HNIs. Its leading market position is reflected in the AUM and distribution of Rs. 4.13 lakh crore as of September 30, 2023 (YoY growth of 24% from Rs. 3.33 lakh crore as of September 30, 2022). It is one of the largest managers of alternative investment funds (AIFs) with an AUM of Rs. 35,633 crore as of September 30, 2023

-

Stable funding buoyed by strong profitability

The consolidated net worth stood at Rs. 3,269 crore as of September 30, 2023, with a reported gearing of 2.46 times. On a standalone basis, 360 ONE Prime reported a capital-to-risk (weighted) assets ratio (CRAR) of 24.03% as of September 30, 2023 (19.78% as of March 31, 2023). The capitalization has been supported by the company’s strong profitability.

-

Comfortable asset quality

360 One Prime provides loans against securities (including AIF investments) to its clients in the wealth management business and the same is sourced by the wealth relationship managers. The loan book accounted for 1.5% of the wealth management AUM as of September 30, 2023.

-

Experienced and stable management

The management has extensive expertise with a track record of over a decade in the field of wealth management.

Weakness

-

Exposure to compliance risk in the wealth management business

Compared to lending operations, wealth management is largely a fee-based business; as such there is a lesser impact in the event of a credit issue. However, wealth and asset management businesses operate in a highly regulated environment, and any unanticipated changes can adversely impact the business model.

-

Low diversity of lending operations

360 ONE Prime, which commenced operations in fiscal 2016, provides LAS to clients of 360 ONE WAM. In general, the size of the book is strongly correlated to the ebbs and flows of the capital and money market, and are affected by both domestic and international events.

Investor Categories

The investor categories in a bond public issue refer to the various segments or types of investors who can take part in the offering. The allocation ratio is determined by the issuer per guidelines set by regulatory bodies such as SEBI for distributing the existing bonds among different types of investors. Here is the allocation ratio for 360 One Prime Limited Public Issue across these investor categories.

Category I- Institutional Portion- 20% of the overall issue size- Public Financial Institutions, Insurance companies, Scheduled Banks, Provident Funds, AIFs, etc.

Category II– Non-institutional Investors- 20% of the overall issue size- Companies, Co-operative Banks, Trusts, Partnership Firms, Association of Persons, etc.

Category III– High Net-worth Individual Investors- 30% of the overall issue size- Resident Indian individuals or Hindu Undivided Families through the Karta applying for an amount aggregating to above Rs. 10,00,000 across all options of NCDs in the Issue.

Category IV– Retail- 30% of the overall issue size- Resident Indian Individuals or Hindu Undivided Families through Karta applying for an amount aggregating up to and including Rs. 10,00,000.

How to Apply for NCD IPO through TheFixedIncome.com?

Information Memorandum:

An Information Memorandum (IM) refers to a detailed document that provides investors with complete information about the bond issue. It contains extensive insights into the issuer’s business, financial background, management team, details of offerings, associated investment risks, and fund allocation from the issue, besides regulatory and legal disclosures.

The link to the Information Memorandum of bond public issue of 360 One Prime Limited is given below:

https://www.thefixedincome.com/storage/bondprimary_imfiles/1704199121360ONE.pdf

Conclusion

Summing up, the bond public issue by 360 One Prime Limited is an excellent opportunity for investors interested in investing in Secured Rated Listed Redeemable Non-Convertible Debentures. Investors can take advantage of this opportunity and reap the returns provided by this issue. However, before investing, investors must go through the IM thoroughly and take into account their risk appetite and investment objectives. Start your investment journey today with TheFixedIncome.com

Disclaimer: This article is based on publicly available information and other sources believed to be reliable. The information provided in this article is intended for general, educational, and awareness purposes only and should not be considered a comprehensive disclosure of every material fact. It should not be interpreted as investment advice for any individual or entity. The article makes no guarantees regarding the completeness or accuracy of the information and disclaims all liabilities, losses, and damages arising from the use of this information. Investments in debt securities/ municipal debt securities/securitized debt instruments are subject to risks including delay and/ or default in payment. Read all the offer-related documents carefully.