Overview

One of the most concerning political and economic issues of this time is climate change, which is only expected to get worse in the coming years. Governments, financial institutions, businesses, and even private citizens are trying to address this issue and lessen the effects of climate change, particularly through decarbonization techniques.

To support the initiatives of green projects for converting an economy into a green economy and reducing carbon footprints, a sizeable capital investment also known as green financing is necessary. So, the government, corporations, and multilateral organizations issue loans, debt mechanisms, and investments for the development of green projects or to minimize the impact of climate change.

First, let us define what green finance is. Green finance is, to put it simply, a loan or investment that supports environmental initiatives. Everyone benefits from its economic and environmental benefits. There are different types of green finance, and one common instrument is green bonds.

In this blog, we will comprehend the definition of green bonds as well as their history, benefits, and drawbacks. Let’s delve into more details.

Understanding Green Bonds

A green bond is a type of investment tool that provides financial support for particular projects related to climate change and the environment. Similar to regular bonds issued by corporations or governments, these bonds are offered to investors. The funds obtained through green bonds are solely dedicated to funding initiatives focused on environmental causes, such as renewable energy projects, sustainable transportation, conservation of biodiversity, and the construction of eco-friendly buildings, among others.

SEBI, in its meeting of the Corporate Bond and Securitization Advisory Committee, has outlined four requirements for bonds to be considered green bonds. These are:

- The money raised must be used to fund green initiatives.

- The method used for project evaluation and selection must be disclosed by the issuer.

- The issuer must also maintain transparency in the management of proceeds.

- They must also provide updates on the status and results of the proceeds.

For assigning the status as green, the broad categories of areas where such money may be invested can be one or more of the following:

- Renewable and sustainable energy

- Clean transportation

- Sustainable water management

- Climate change adaptation

- Energy efficiency

- Sustainable waste management

- Sustainable land use

- Biodiversity conservation

However, it is to be noted that this is only an indicative list and may include other categories as specified by the board. Furthermore, if an issuer uses a proportion of the proceeds of the issue of green bonds for refinancing existing green bonds, it shall be clearly stated in the offer document, and wherever possible, it shall also provide the details of the refinancing projects.

How are Green Bonds different from Traditional Bonds?

Let us look at the key difference between a green bond and a conventional bond. Green bonds function similarly to conventional bonds in that an investor lends money to a company to fund a project, and the investor receives the principal sum at the end of the loan’s term and interest payments.

The underlying project that is funded with the proceeds is the main distinction between a conventional bond and a green bond. Unlike conventional bonds, which are typically issued to finance general projects, general working capital needs, or refinance existing debt, green bonds are only issued to fund environmental projects.

History of Green Bonds

In 2007, the Intergovernmental Panel on Climate Change released a report on global warming and human activity, which prompted numerous Swedish pension funds to invest in green initiatives.

In response to this rising demand, the World Bank first issued its green bond in 2008. Since then, the market for green bonds has been on the rise.

The history of these bonds, however, is connected to the City of San Francisco, where a ‘solar bond” was approved to finance renewable energy. Additionally, in 2007, a few development banks, including the European Investment Bank, issued this kind of equity index-linked bond.

The world’s biggest issuer of green bonds is the United States. Yes Bank in India issued the country’s first green bond in 2015 to raise INR 5 billion for infrastructure investments in renewable and clean energy.

The government of India issues Sovereign Green Bonds as a means to raise funds for environmentally-friendly infrastructure. The proceeds generated through these bonds are used in public sector initiatives that contribute to the reduction of carbon emissions.

The RBI auctioned two Sovereign Green Bonds, NEW GOI SGrB 2028 and NEW GOI SGrB 2033 worth Rs. 8000 crores on January 25, 2023, with a cut-off yield of 7.10% and 7.29% respectively. Subsequently, on February 9, 2023, it declared the issuance of an additional Rs 80 billion in sovereign green bonds.

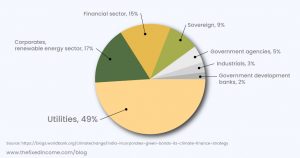

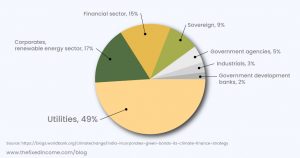

The largest green bond issuer in India is Greenko Group, which funds hydro, solar, and wind power projects in many Indian states with its green bond proceeds. Indore Municipal Corporation issued green bonds worth USD 87 million in 2023. The private sector alone was responsible for 84% of the total green bonds that were issued.

If you are someone seeking investment opportunities in bonds, you can consider the TheFixedIncome platform. Nonetheless, it is advisable to do thorough research and analysis before investing in any bond so that you can learn fully about the issuer’s financial standing and creditworthiness.

The projects that have been identified are in sectors such as transportation, renewable energy, power, and urban development. They have been divided into categories such as “dark green” and “medium green,” which are based on credit and ratings.

According to the government’s framework, the interest and premium payments of the bonds are not based on how well the projects perform, and investors are also not liable for any project-related risks.

Advantages of Green Bonds

- These bonds support the capital structure of the issuers. Typically, the holders of such bonds are permitted to use a portion of the proceeds to settle other debt and for working capital. The proceeds may also be used by the issuer to replace expensive debt on current green projects. However, new debt can only be issued if the issuer has a strong track record of performance and a favorable credit rating.

- Green bonds improve the issuer’s reputation as they can promote themselves, thereby showcasing their dedication to sustainable development. The issuers issuing green bonds earn the reputation of society as they are seen as environmentally friendly entities.

- The yield on green bonds is relatively high. Therefore, they are a wise investment option.

- Green bonds are a great way to finance a cost-intensive investment project.

- The funds raised are utilized in climate-friendly projects, thereby working towards the cause of saving the environment.

- If the demand for green bonds is higher, it causes a decrease in interest rates, which means the company is spending less from its pockets.

- The interest cost of issuing green bonds is usually lower than that charged on loans by banks and financial institutions. Hence, they have a direct impact on the cost of starting environmentally friendly projects. They also create a positive impact on other entities by encouraging them to undertake such projects and go green. Thus, these green bonds draw people who are environmentally conscious to support environmental concerns.

- Green projects are in high demand from foreign investors. So, it is possible to reduce the expense of fundraising.

Disadvantages of Green Bonds

- At times, these bonds have drawn criticism regarding the issuer’s use of the proceeds. In some cases, they did not fit into the green category.

- These bonds do not have any appropriate rating standards.

- These bonds might not always provide the liquidity that some investors, primarily institutional investors, may require.

Conclusion

Summing up, green bonds are an effective tool for promoting sustainable development and combating climate change. With increasing awareness and support, green bonds have the potential to unlock new opportunities and help create a greener economy. As a result, the financial landscape can also change.

The seasoned experts at TheFixedIncome can help investors in their investment journey by providing details about the latest bond offerings, thereby creating a diversified bond portfolio.

Disclaimer: Investment in the securities market is subject to market risks, read all documents carefully before making any investment.

FAQs

Q1. When was the first green bond issued?

Ans. In 2007, a group of Swedish funds took part in investment opportunities that would benefit the environment. By November 2008, the World Bank issued the first green bonds and effectively gathered capital from investors for climate-related projects.

Q2. How do green bonds differ from conventional bonds?

Ans. There are no differences between green bonds and conventional bonds. Green bonds are similar to traditional bonds in their deal structure; only that green bond proceeds are used to finance environmental projects. They also have different requirements for reporting, auditing, and processing allocations. Thus, these additional requirements offer marketing and branding value not found in traditional bonds.

Q3. How do green bonds work?

Ans. Green bonds work similarly to corporate or government bonds. They are issued by borrowers to raise funds for environmental projects.

Q4. Who can issue green bonds?

Ans. Green bonds are issued by any sovereign entity, inter-governmental groups, or alliances, and corporates for raising funds to finance projects that are classified as environmentally sustainable.