Muthoot Fincorp Limited is coming up with Secured, Rated, Listed, Redeemable Non-Convertible Debentures which is opening on January 12, 2024, and closing on January 25, 2024. This is an attractive investment opportunity for investors because of its AA-/Stable rating by CRISIL Limited supported by the company’s strong profile and impressive financial track record. This blog provides information about the company, delves into the issue, and its financial performance. Here are the details of the issue:

Issue Highlights

| Issuer Name | Muthoot Fincorp Limited |

| Nature of Instrument | Secured Rated Listed Redeemable Non-Convertible Debentures |

| Rating | AA-/Stable by CRISIL Limited |

| Seniority | Senior |

| Face Value | Rs. 1,000 per NCD |

| Base Issue Size | Rs. 75 crore |

| Option to retain oversubscription | Rs. 225 crore |

| Coupon | Up to 9.75% |

| Tenor | 24/36/60/96 months |

| Issue Date | January 12, 2024, to January 25, 2024 |

| Minimum Investment | Rs. 10,000 only |

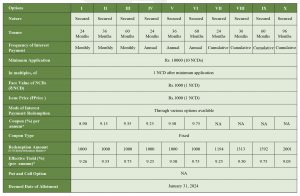

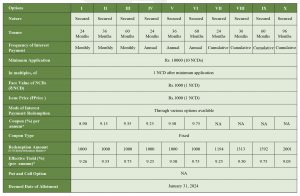

Specific Terms of the NCD Public Issue across different series

Company Profile

- Muthoot Fincorp Limited is a systemically important non-deposit-taking NBFC that has been in business for over 25 years.

- Muthoot Fincorp Limited is a part of the “Muthoot Pappachan Group” which has diversified business interests ranging from 69 hospitality, financial services, inflight catering, infrastructure for information technology, automobile sales and services, and real estate.

- Muthoot Fincorp Limited is one of the prominent gold loan players in the Indian Market and it operates in 3,619 branches located across 24 states, including the union territory of Andaman & Nicobar Islands and Delhi, and employs 20.507 employees.

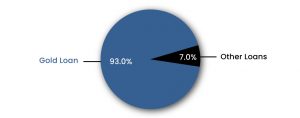

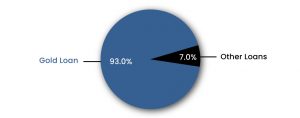

Gold Loan as a % of the total Loan Book (as of September 30, 2023)

Key Operational and Financial Parameters (Standalone)

(Rs. in lakhs)

| Particulars | H1 FY 2024 | FY 2023 | FY 2022 | FY 2021 |

| Loan Under Management | ₹ 20,01,029.33 | ₹ 17,61,507.49 | ₹17,32,313 | ₹18,68,938 |

| Gold Held as Security (in tonnes) | 48.93 | 48.01 | 54.03 | 59.40 |

| Capital Adequacy Ratio | 19.88% | 21.34% | 19.42% | 16.85% |

| Net Stage 3 Assets (NPA) | 3.02% | 0.58 % | 1.57% | 1.01% |

| Profit after Tax for the year | 20,088.06 | 45,981.08 | 34,685.13 | 36,953.74 |

| Net Worth | 4,09,221.47 | 3,89,303.45 | 3,44,949.33 | 3,20,078.80 |

Financial Metrics across Muthoot Fincorp Limited’s Businesses

- As of September 30, 2023, Muthoot Fincorp Ltd. had approximately 31.68 lakh Gold loan accounts, aggregating to Rs. 18,61,232.55, which comprised 93.01% of the total loan portfolio.

- For the six months ended September 30, 2023, and Fiscal 2023, Fiscal 2022 and Fiscal 2021 revenues from the Gold loan business constituted 88.52%, 92.09%, 93.04%, and 93.60% of the total income on a standalone basis as per Ind AS, respectively.

- For the six months ended September 30, 2023, Fiscal 2023, Fiscal 2022, and Fiscal 2021 the company’s Gold loan portfolio yield (representing interest income on gold loans as a percentage of average outstanding Gold loans), were 18.83%, 20.12%, 18.74% and 21.62% per annum, respectively, on a standalone basis as per Ind AS.

- For the six months ended September 30, 2023, and for the Fiscal 2023, Fiscal 2022, and Fiscal 2021, the gold loan portfolio of the company earned an interest of ₹1,58,354.21 lakhs, ₹ 3,21,521.00 lakhs, ₹ 3,09,629.21 lakhs and ₹2,91,839.88 lakhs on standalone basis as per Ind AS, respectively.

- The company’s capital adequacy ratio as of September 30, 2023, March 31, 2023, March 31, 2022, and March 31, 2021, computed based on applicable RBI requirements was 19.88%, 21.34%, 19.42%, and 16.85%, respectively, on standalone basis as per Ind AS, compared to RBI stipulated minimum requirement of 15%, with Tier I Capital comprising 15.61%, 16.48%, 14.73% and 12.09%, respectively.

Rating Rationale

The rating rationale outlines the following key factors influencing the ratings of Muthoot Fincorp Limited:

Strengths

-

Strong market position in gold financing, aided by the extensive experience of the promoters

MFL has established a prominent market presence in gold financing. The promoters have dedicated over seven decades to the business of lending against gold jewelry thereby helping the group build a strong reputation and brand, particularly in South India. They’ve developed effective assessment and underwriting methods. As of fiscal year 2023, MFL’s gold loans AUM amounted to Rs 17,942 crore.

-

Diversified product range offered by the MPG group

MPG has diversified its range of products over the past few years and operates in five major segments: loans against gold jewelry, two-wheeler finance, microfinance, housing finance, and small business loans. As of March 31, 2023, MPG’s overall managed AUM stands at approximately Rs 31,587 crore, up from Rs 28,308 crore as of March 31, 2022.

-

Improvement in capitalization following the recent influx

As of March 31, 2023, MFL’s net worth, at the standalone level, stood at Rs 4,050 crore (including CCCPS), compared to Rs 3,602 crore on March 31, 2022. The capitalization is supported by minimal risks on the asset side, backed by the security of gold jewelry, a liquid asset held by the lender.

-

Strong asset quality within the gold loan segment to support overall group asset quality

MFL has maintained robust asset quality in the gold loan segment over the years, supported by strong collection efficiency. Their credit costs, a key measure of asset quality, have been under control within 0.5% during this period for gold loans, even standing at 0.3% in fiscal year 2023. Post the second wave of COVID-19, the company has been doing regular auctions since June 2021. Moreover, they are focusing on a shorter tenure (6-month) gold loan product, compared to an average tenure of 9-month product in the previous fiscal. This should help MFL reduce portfolio risk from sudden fluctuations in gold prices in the near term.

-

Enhancing earning profile for gold loan business

MFL’s standalone profitability has improved over the past 2-3 years due to higher returns from the gold business during the pandemic, a steady reduction in overall operational costs over the years, and overall low credit costs.

Weakness

-

Area-based concentration in the portfolio

The gold loan portfolio as of March 31, 2023, is concentrated in South India, with approximately 60%. This was made possible by increasing business volume per branch other than the southern branches, opening new branches in the North, East, and South, and merging or shutting down branches in South India that were not financially sustainable.

-

Potential difficulties linked with non-gold loan segments

As of March 31, 2023, the non-gold segments made up 43% of the total portfolio. Although MPG has managed to expand these businesses and raise the segmental share over the last 2-3 years, there are potential challenges related to the seasoning of the loan book and the quality of assets that still need attention.

Investor Categories

The investor categories in a bond public issue can be defined as the various segments or types of investors who can take part in the offering. The allocation ratio is made by the issuer by following the guidelines set by regulatory bodies such as SEBI for distributing the existing bonds among different investor categories. Here is the allocation ratio for the Muthoot Fincorp Limited Public Issue across these categories.

Category I- Institutional Portion- 5% of the overall issue size- Public Financial Institutions, Insurance companies, Scheduled Banks, Provident Funds, AIFs, etc.

Category II– Non-institutional Investors- 35% of the overall issue size- Companies, Co-operative Banks, Trusts, Partnership Firms, Association of Persons, etc.

Category III– Retail- 60% of the overall issue size- Resident Indian Individuals or Hindu Undivided Families through Karta applying for an amount aggregating up to and including Rs. 10,00,000.

How to Apply through TheFixedIncome.com?

Information Memorandum:

An Information Memorandum (IM) is an extensive document that provides investors with in-depth information about the bond issue. It contains detailed insights into the issuer’s business, financial background, management team, details of offerings, associated investment risks, and fund allocation from the issue, besides regulatory and legal disclosures.

The link to the Information Memorandum of bond public issue of Muthoot Fincorp Limited is given below:

https://www.thefixedincome.com/storage/bondprimary_imfiles/17044492111704171979491.pdf

Conclusion

Summing up, the bond public issue by Muthoot Fincorp Limited is an excellent opportunity for investors interested in investing in Secured Rated Listed Redeemable Non-Convertible Debentures. Investors can avail this opportunity and reap the returns provided by this issue. However, before investing, investors must read the IM thoroughly and consider their risk appetite and investment objectives.

Disclaimer: This article is based on publicly available information and other sources believed to be reliable. The information provided in this article is intended for general, educational, and awareness purposes only and should not be considered a comprehensive disclosure of every material fact. It should not be interpreted as investment advice for any individual or entity. The article makes no guarantees regarding the completeness or accuracy of the information and disclaims all liabilities, losses, and damages arising from the use of this information. Investments in debt securities/ municipal debt securities/securitized debt instruments are subject to risks including delay and/ or default in payment. Read all the offer-related documents carefully.