Bonds are the perfect solution for investors who seek to diversify their portfolios. Bonds are often seen as a lower-risk and more reliable form of investing compared to stocks, but there are some things you need to know before investing in bonds. This comprehensive bonds guide covers all the basics of bonds and provides essential information on what you should consider when buying bonds. Whether you’re a beginner or an experienced investor, this bonds guide will help you decide the best bonds to buy which will fit rightly in your portfolio.

As we know, not all bonds are the same; some have better risk-to-reward ratios than others. In this blog, we will discuss factors to be considered before investing in bond markets, the best bonds to buy that suit your financial portfolio, and how you might be able to use them effectively in 2023!

What are Bonds?

A bond is a debt instrument issued by governments, corporations, and municipalities. It can be traded on the secondary market and it has different denominations as well as different maturities.

Bonds have a fixed interest rate until maturity, meaning that no matter how much time passes between now and when the bond matures (or reaches its final maturity date), its total face value remains constant and on maturity, the investor receives the invested amount back.

Say, if you invest ₹100,000 in a 5-year bond paying a 9% coupon rate. In this case, the investor will receive ₹9,000/- interest every year and at the end of 5 years, the entity will pay back ₹100,000 that you initially invested.

The role of bonds in the portfolio

Bonds are a type of debt. They’re different from shares, which are the stock of a company. Because they’re debt, bonds pay interest on a regular basis. This means that you can earn money by investing in bonds and you’ll be able to use your funds as you wish – whether it’s to buy something or pay off your debts. Bonds can also be used as a way to save money for retirement or for other reasons.

Bonds are a safe investment that can provide you with a steady income and help you diversify your portfolio. Bonds are one of the stable investment options in the financial market. The risk involved with bonds is low, but it does exist. Bond risk can be high for some individual bonds, so make sure you assess factors associated with buying bonds before you invest.

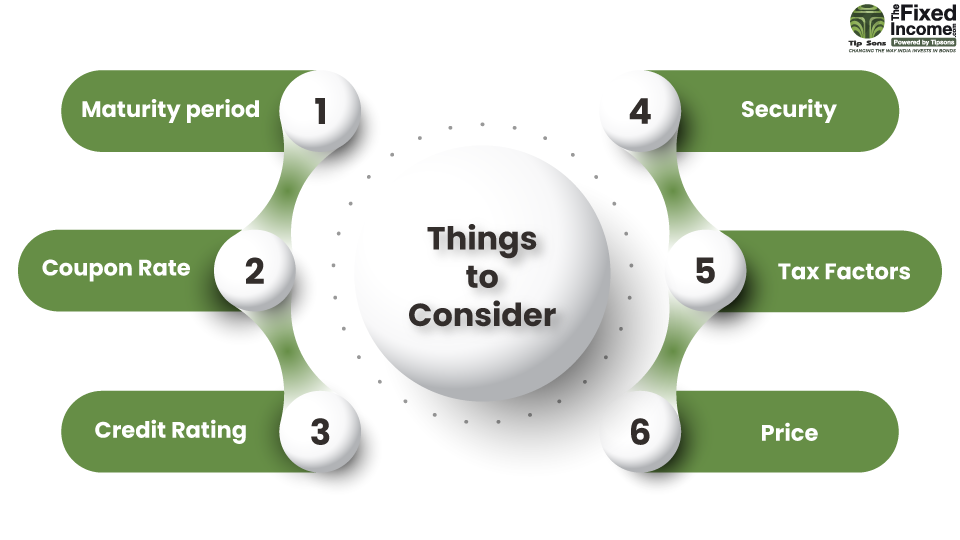

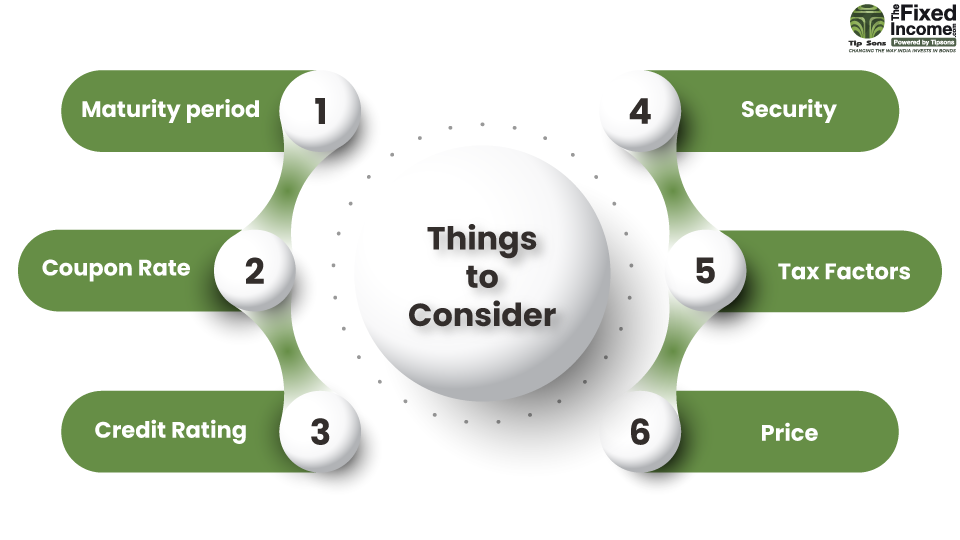

Before you buy, there are a few things to consider:

-

Maturity Period :

The maturity of a bond is the length of time until the bond comes due and the bondholder receives the par value of the bond. Generally, bond term ranges can be categorized as follows:

Short Term: maturities for up to 5 Years

Medium Term: maturities of 5-12 Years

Long Term: maturities more than 12 Years

The maturity date is crucial because it determines the time at which a bond issuer pays you back the money you loaned. Typically, longer-term bonds tend to provide greater overall returns, compensating investors for greater pricing fluctuations and other market risks. Bonds of a particular maturity should be chosen based on your financial goals.

-

Coupon Rate:

The coupon rate is stated as a percentage of the face value of a bond and is used to calculate the interest the bondholder receives. Normally, the coupon is paid to bondholders on an annual or semi-annual basis. Bonds are issued at different coupon rates which means that the interest rate paid on the bond will vary depending on which issuer you buy from (e.g., corporate bond or government bond, etc.). In fact, it is a secondary income for many investors, so one should consider it accordingly.

-

Credit Worthiness of Issuer :

Credit risk is considered the major risk in which the bond issuer may default on one or more payments before the bond maturity. This default can be in the form of untimely payment of coupons or non-payment of the principal at the time of maturity.

The default is assessed by the rating assigned to the bond by authorized agencies based on a rating scale. The higher end of the ratings indicates better credit quality, lowering the chances of default and the lower end ratings indicates higher chances of default. Credit Rating agency customarily gives alphanumeric ratings from AAA (Most safe) to D (Least safe) based on the security and safety of the instruments.

-

Security :

Bonds can be divided into two types. There are two types of bonds: secured bonds and unsecured bonds. Bonds that are secured are bonds backed by a security, so if the company is unable to repay the obligation, the secured debt holders have the first claim to the collateral.

The term unsecured bonds refer to bonds that have no collateral backing them. Interest and principal payments are guaranteed solely by the issuer, but there is no asset backing. Unsecured bonds usually offer a higher rate than secured bonds due to a higher level of risk.

-

Tax Factors :

Income from bonds is usually taxable. Nevertheless, there are certain options that you can use to obtain tax benefits, such as 54 EC Bonds, Tax-free bonds, green bonds, etc. However, bonds with tax-exempt features tend to have lower interest rates. A comparison between taxable bonds and tax-free bonds can provide insight into the right choice for your portfolio.

-

Price

The price of a bond is based on factors like interest rates, supply-demand, liquidity, credit rating, maturity, and tax status. The market value of a bond is directly related to the interest rates as they have an inverse relationship. As interest rates go up, the market prices of bonds go down and when the interest rates go down, the market prices of bonds go up. If you sell your bond before it matures, the price may be more or less depending on the current interest rates of the bond than you originally paid for it.

Conclusion

As with any type of investment, there are risks and rewards associated with investing in bonds. Risk is something that everyone is familiar with. However, rewards are often overlooked or not fully understood. When it comes to investing in bonds, the rewards are that you’ll receive regular interest payments from the bond issuer. The amount of these payments is usually fixed when the bond is issued and is written into the terms and conditions of the bond.

To conclude, bonds investment provide an excellent hedge against inflation, make passive income, or save for retirement. Bonds are low-risk investments that provide steady growth in your portfolio over time. This is because they don’t fluctuate as much as other riskier asset classes—and when they do, they tend not to lose much value! Tax benefits are also offered by some types of bonds. The best part about buying bonds? You don’t have to worry about losing any money since there aren’t any big swings in value either way!