Navi Finserv Limited is coming up with Secured, Rated, Listed, Redeemable Non-Convertible Debentures which will be available for subscription from February 26, 2024, to March 07, 2024. This presents an attractive investment prospect for investors as it holds a credit rating of A/Stable by CRISIL. This blog aims to provide information about the company, its offerings, and financial performance. The details of the issue are given below:

Issue Highlights

| Issuer Name | Navi Finserv Limited |

| Nature of Instrument | Secured Rated Listed Redeemable Non-Convertible Debentures |

| Rating | A/Stable by CRISIL |

| Seniority | Senior |

| Face Value | Rs. 1,000 per NCD |

| Base Issue Size | Rs. 3,000 million |

| Option to retain oversubscription | Rs. 3,000 million |

| Coupon | Up to 11.19% |

| Tenor | 18/27/36 months |

| Issue Date | February 26, 2024 to March 07, 2024 |

| Minimum Investment | Rs. 10,000 only |

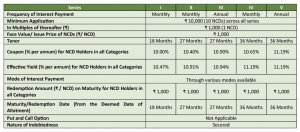

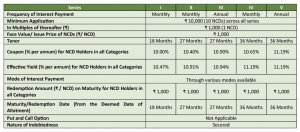

Specific Terms of the NCD Public Issue across different series

Company Profile

- Navi Finserv Limited is a non-deposit taking, systemically important NBFC registered in Bengaluru. Navi Finserv Limited was founded on February 14, 2012, as Chaitanya Rural Intermediation Development Services Pvt. Ltd. The company’s name was changed to Navi Finserv Limited on April 22, 2020.

- Navi Technologies Limited, the promoter of Navi Finserv Ltd., operates the asset management business through its subsidiary Navi AMC Limited, and general insurance through Navi General Insurance Limited.

- Mr. Sachin Bansal (Ex Chairman and Co-founder of Flipkart) is the Executive Chairman and Chief Executive Officer of Navi Finserv Limited.

- Svatantra Microfin has acquired Chaitanya India Fin Credit, a subsidiary previously owned by the Navi Group. This substantial acquisition, valued at Rs 1,479 crore, was officially declared in August 2023.

- As on March 31, 2023, the Standalone AUM stood at ₹ 70,153.12 Mn. and the employee size was 955 as of September 2023.

- Navi Finserv Limited offers products such as

- Home Loans

- Personal Loans

Performance Highlights of Navi Finserv Limited for the six months ended September 30, 2023 (Standalone Basis)

Metrics across Navi Finserv Limited’s Business:

- Navi Finserv considers the digital lending process as one of the key differentiators driving business growth. Mr. Sachin Bansal, the promoter, has embraced a mobile-first strategy, leveraging the robust in-house technology and product knowledge to develop customer-centric products.

- In the personal loan segment, Navi extended 1,010,761 personal loans, with an average loan size of ₹60,708 in the 6 month period ending on September 30, 2023.

- Since inception, Navi has granted personal loans to customers in over 99.69% of all Indian pin codes.

- As of September 30, 2023, Navi Finserv Ltd. had an AUM of ₹7,257.62 million under home loan products and since launch have disbursed loans amounting to ₹11,785.56 million with an average ticket size of ₹6.24 million.

Key Operational and Financial Parameters (Standalone – Rs in million)

| Particulars | FY 2021 | FY 2022 | FY 2023 |

| AUM | 6,260.63 | 29,492.66 | 67,910.07 |

| Interest Income | 1,947.24 | 3,141.85 | 11,807.85 |

| Profit/ (Loss) for the year | 975.42 | (669.08) | 1,719.86 |

| Net Worth | 11,526.00 | 11,852.62 | 22,698.64 |

| Gross NPA (%) | 4.46% | 0.87% | 1.70% |

| Net NPA (%) | 0.25% | 0.04% | 0.31% |

| Capital Adequacy Ratio (%) | 38.04% | 30.73% | 28.37% |

List of top holders of non-convertible securities in terms of value as on December 31, 2023 (on cumulative basis):

| Sr. No | Name of holders | Holding as a % of total outstanding non-convertible securities of Company |

| 1. | Navi Technologies Limited | 15.73% |

| 2. | Sundaram Finance Limited | 5.24% |

| 3. | Aditya Birla Finance Limited | 4.82% |

| 4. | Sporta Technologies Private Limited | 3.99% |

| 5. | Vivriti Alpha Debt Fund | 2.29% |

Rating Rationale

CRISIL in its rating rationale outlines the following key factors influencing the ratings of Navi Finserv Limited:

Key Rating Drivers

Capitalization remains robust and is poised for further enhancement post the listing of the holding entity: Mr. Sachin Bansal holds about 98% in NTL, which in turn holds 99.6% stake in Navi Group. The capitalization of Navi group has improved to great extent driven by a cumulative capital infusion of Rs 1,950 crore by Mr. Sachin Bansal through NTL.

Stabilizing asset quality with evolution in risk management systems: The risk management systems of the group have been advancing with scale notably through increasing effectiveness of the Navi app and the digital underwriting and monitoring model used by the group.

Improving profitability: For NFL, which reported a net loss for fiscal 2022 due to high marketing expenditure for launch of its housing loan book and branding costs, earnings have improved significantly in fiscal 2023 driven by a decline in marketing costs in general, ability to charge a higher premium for loans from repeat customers, and correction in credit costs.

Improving resource profile: The resource profile of Navi Group has improved. The group’s lender base has broadened with more banks joining and cost of borrowing has also remained competitive on fresh borrowings post equity infusion in October 2019.

- Despite gradual diversification into various regionsl over the years, 64% of the company’s AUM is concentrated in three states – Karnataka (29%), Bihar (18%) and Uttar Pradesh (18%). This raises the vulnerability of asset quality to regional socio-political issues that are an inherent risk to the microfinance industry.

Liquidity: Strong

Navi group’s liquidity position remains strong. As on March 31, 2023 – NFL had Rs 818 crore as liquidity available in the form of cash and liquid investments.

Key factors to monitor as highlighted in the rating rationale

Any change in stance of support committed by NTPL to Navi group – potentially leading to capital position being weaker than that estimated; significant rise in gearing for Navi group to beyond 3.5 times.

Any deterioration in overall or standalone asset quality and profitability, constraining the internal accruals to networth.

(Source: CRISIL Rating Rationale)

Investor Categories

The categories of investors in a bond public issue can be defined as the different segments or types of investors who can take part in the offering. The issuer assigns these categories based on guidelines laid by regulatory bodies such as SEBI, to allocate the available bonds among various investor groups. Here is the allocation ratio for Navi Finserv Limited’s Public Issue across these categories.

Category I- Institutional Portion- 20% of the overall issue size- Public Financial Institutions, Insurance companies, Scheduled Banks, Provident Funds, AIFs, etc.

Category II– Non-institutional Investors- 25% of the overall issue size- Companies, Co-operative Banks, Trusts, Partnership Firms, Association of Persons, etc.

Category III– High Net-worth Individual Investors- 25% of the overall issue size- Resident Indian individuals or Hindu Undivided Families through the Karta applying for an amount aggregating to above ₹ 10,00,000 across all options of NCDs in the Issue.

Category IV– Retail- 30% of the overall issue size- Resident Indian Individuals or Hindu Undivided Families through Karta applying for an amount aggregating up to and including ₹10,00,000.

Apply easily using the following three steps:-

Information Memorandum:

An Information Memorandum (IM) is an extensive document that provides investors with detailed information about the bond issue. It serves as a crucial reservoir of information for investors to thoroughly evaluate the bond and make well-informed decisions. Generally, an IM includes intricate details about the issuer’s business, financial history, management team, details of the offering, related investment risks, and allocation of funds from the issue, and also contains regulatory and legal disclosures.

The link to the Information Memorandum of bond public issue of Navi Finserv Limited is given below:

https://www.thefixedincome.com/storage/bondprimary_imfiles/1708086262NAVIIM.pdf

Conclusion

Wrapping up, the bond public issue by Navi Finserv Limited presents an excellent opportunity for investors seeking to venture into Secured Rated Listed Redeemable Non-Convertible Debentures. Backed by a strong company profile, impressive financial track record, and A/ Stable ratings, these are key factors that draw investors from diverse categories. Nonetheless, investors must go through the IM thoroughly before investing and take into account their risk appetite and investment objectives.

Disclaimer: This article is based on publicly available information and other sources believed to be reliable. The information provided in this article is intended for general, educational, and awareness purposes only and should not be considered a comprehensive disclosure of every material fact. It should not be interpreted as investment advice for any individual or entity. The article makes no guarantees regarding the completeness or accuracy of the information and disclaims all liabilities, losses, and damages arising from the use of this information. Investments in debt securities/ municipal debt securities/securitized debt instruments are subject to risks including delay and/ or default in payment. Read all the offer-related documents carefully.