You can unwind and take it easy throughout your retirement years. To live a happy retirement life and savor the simple things in life, one must make financial preparations. Your financial decisions today will influence your retirement lifestyle because you won’t have a steady salary in retirement. The earlier you plan, the better returns you would expect on your savings or investments. Without a retirement plan and wise investments, life becomes challenging. The sum required to enjoy retirement is based on several factors.

As a result, one should choose the investment strategy that best suits their needs and objectives. Among the few fixed income possibilities, bonds are a popular choice. Planning for a future that most people don’t fully understand is difficult. Thus, retirement planning has gotten harder. Due to the lack of a defined retirement pension program, this is particularly true for Indian investors. Investors must weigh various options to build a significant savings pool for their retirement. One of those opportunities is a bond investment, which every responsible investor should undertake.

Advantages of Early Retirement Planning

-

ROI

By making an investment in a retirement plan instrument, you can accumulate money over time and watch it grow. In accordance with your unique financial circumstances, you must decide which investing tool is ideal for you. The profits will be better if you plan such an investment at the right time. You can satisfy the financial expectations in the right way by calculating the quantity of money you’ll need. Therefore, the benefits of retirement planning in terms of returns might be enhanced.

-

Tax Benefits

Today, a variety of financial tools are accessible to help you and your partner develop a solid retirement strategy. According to the current tax legislation, investing in a proper plan gives you the opportunity to lower your taxable income. Your income source may feel less burdensome while you secure a fund for the future. Additionally, you are able to better control your investment expenses thanks to the tax advantages of retirement planning.

Other important points:

Compounding

We all agree that we can create a sufficient retirement fund by setting aside some of our income. However, such strategy is ineffective since we neglected to account for inflation. Compounding’s strength enables you to have a larger retirement fund.

Future Financial Flexibility

Examine your present financial stability before making an investment in a retirement plan. Your assets and income sources will also be evaluated. Establish financial objectives for yourself and decide on a retirement age. Setting a goal for your retirement is one example of this. As an illustration, you desire a 50-year-old early retirement. Now you can pick a strategy that will give you practical possibilities for retirement at 50.

Account for Inflation

The cost of life and the worth of money will change throughout time. Maintaining your lifestyle costs a little more money each day. When you have retired from your career, it can be difficult to meet your financial obligations. Fortunately, one of the advantages of retirement planning is reducing inflation rates. In order to have adequate money for the future, you as an investor must take this into account when making investing decisions now.

Why Are Bonds Best For Early Retirement Planning?

Because choosing an early retirement is a wise course of action, you must make wise preparation selections. Bonds remain the best option for retirees even though interest rates and inflation rose this year. Through purchasing bonds and financial instruments, a shareholder lends money to organizations or the government in exchange for interest. Sealants provide a consistent set rate of return up until their maturity. Because of this quality, bond income is predictable. A retirement plan must have such a predictability element.

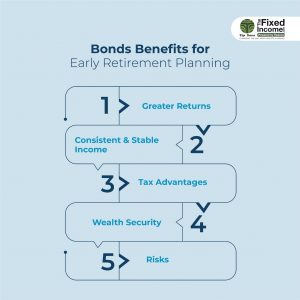

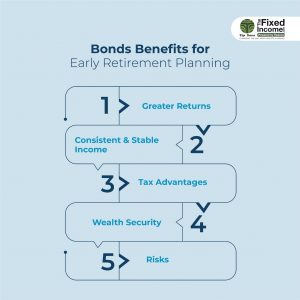

Bonds Benefits for Early Retirement Planning

Bonds are superior to other investment options in several ways. When there is severe inflation, it is an excellent alternative to fixed deposits and the best option.

- Greater Returns– Bonds are renowned for providing higher returns on your investment. It provides good bond returns. The interest rate changes based on the maturity time and the kind of issuer.

- Consistent and Stable Income– Bonds have a consistent and stable income. It can help you efficiently plan your objectives, including retirement. A steady income has its advantages. You can plan your future investments based on your anticipated income while also considering your retirement financing needs.

- Tax Advantages– Because tax affects your returns, it’s also a significant concern for many investors. The simple returns that can be taken into account are those that were obtained after taxes. Bonds with the tax exemption feature are preferred for their tax-free characteristic. A tax exemption or a minimum tax can help you earn more money and build a surplus so that you can retire early at any time in the future.

- Wealth Security– A risky financial choice should be avoided by investors preparing for retirement. Look at the rating of the most highly rated or suggested bonds for improved early retirement planning. Make sure your investment provides capital protection. Bonds are frequently recommended as a good option for early retirement planning since they offer capital protection.

- Risks– The risk would worry investors. Risks could have a significant impact on your financial goals. Therefore experts advise you to take them seriously. Attempt to buy bonds with higher ratings. Bonds with an AAA rating are considered risk-free.

Conclusion

You can start thinking about retiring at any time. It may seem complicated, but choosing the correct retirement portfolio will depend on your age, spending, and risk tolerance. Diversity is the only principle that has endured through the ages. In the years leading up to your retirement, bonds are the best early retirement planning benefit as it provides stability and diversification. Bonds offer tax advantages that retirement investors should take into account. All investors, both new and seasoned, can now trade bonds simply and effectively.